Hemon’s Article

(Note: all recommendations are based on personal experiences. Reading requires in order)

Greeting! Young and ambitious students. Welcome back to business. I hope you all did

well in your quarterly academic assessment. If not… well… It is what it is. Nevertheless, it is

time to get back into the real game. Here are list of personal finance book to refresh your mind:

- Think and Grow Rich

“Think and Grow Rich” is a timeless self-help and personal

development book written by Napoleon Hill in 1937. It offers a blueprint

for achieving success and wealth by emphasizing the power of mindset,

clear goals, unwavering belief, and persistent action. The book distils

the success principles of many accomplished individuals and encourages

readers to adopt a positive and goal-oriented mindset to achieve their

aspirations.

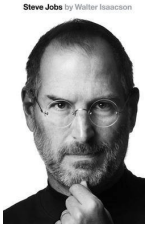

2. Steve Job (book)

The book “Steve Jobs” is a biography written by Walter Isaacson. It

provides a comprehensive and in-depth exploration of the life and

career of Steve Jobs, the co-founder of Apple Inc. The book delves into

Jobs’ innovative and sometimes controversial leadership in the

technology industry, his impact on the world of consumer electronics,

and his complex personality. It offers insights into the visionary

entrepreneur who revolutionised multiple industries with products like

the iPhone, iPad, and Macintosh, and it provides a deeper

understanding of his successes and challenges.

3. The Millionaire Next Door: The Surprising Secrets of

America’s Wealthy

“The Millionaire Next Door: The Surprising Secrets of America’s

Wealthy” is a book by Thomas J. Stanley and William D. Danko. It

presents a detailed examination of the habits, lifestyles, and

financial strategies of everyday millionaires in the United States.

The book challenges common misconceptions about wealth and

reveals that many millionaires are not extravagant spenders but

rather prudent savers and investors. It offers practical insights into

building and maintaining wealth, emphasizing the importance of

frugality, diligent saving, and making informed financial decisions.

Leave a comment