Park chae eun

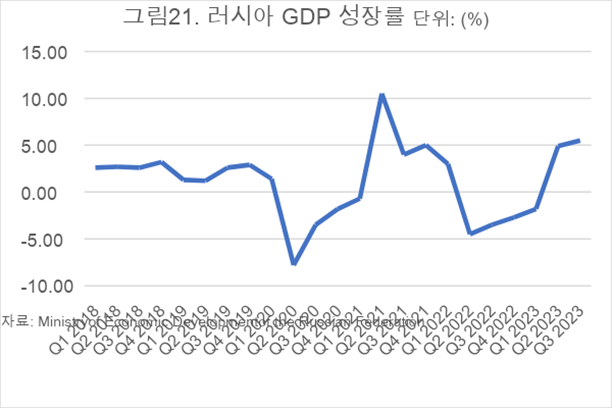

After the outbreak of the Russia-Ukraine war on February 26, 2022, Western countries, including the United States, excluded Russian banks from the SWIFT payment network. SWIFT, established in 1973 for financial transactions and settlements among financial institutions globally, has become inaccessible to countries subject to such exclusion measures. This results in practical exclusion from international trade, as they cannot receive or make payments for export and import transactions. Despite the SWIFT exclusion implemented to directly impact the Russian economy, Russia has continued to show consecutive negative growth in the fourth quarter following the outbreak of the war in February of the previous year. Nevertheless, in the second quarter of this year, Russia recorded a growth rate close to 5%. This suggests that, at this stage, the powerful sanctions imposed by the West, utilizing the dollar’s status as the primary reserve currency, have not collapsed the financial market.

Furthermore, because of Russia’s SWIFT exclusion, concerns about sanctions have increased among countries with different systems, such as the United States, Europe, and Japan. This has led to a rise in transactions using the Chinese Yuan (Renminbi), evident in the increased average daily transaction volume of the Cross-Border Interbank Payment System (CIPS), which is 1.5 times higher than before the invasion of Ukraine, reaching 21,000 transactions. Over the past year, more than 100 financial institutions have newly joined CIPS. Thus, while SWIFT exclusion may have short-term effective economic impacts on targeted countries, from a long-term perspective, it could act as a catalyst for moving away from the dollar-centric payment network and fostering the establishment of an alternative international payment system. This may underscore the need for other countries to reduce their dependence on the U.S. dollar, potentially weakening its status as the world’s primary reserve currency.

Leave a comment