Hemon’s Article

So, you’ve probably heard the term “valuation” thrown around before, right? It’s essentially the process of figuring out how much something is worth. Whether it’s a company, a piece of real estate, or even your neighbor’s vintage comic book collection, valuation helps put a price tag on things.

Now, you might wonder, why does this matter? Well, knowing the value of something is crucial for all sorts of reasons. It helps investors decide whether to buy or sell stocks, it guides companies in making strategic decisions, and it even helps individuals understand their own net worth.

Valuation involves looking at a bunch of factors – financial performance, market trends, future prospects, you name it. It’s like putting together a puzzle where each piece represents a different aspect of value.

So, without any further ado let me introduce you to the core essential model of valuation.

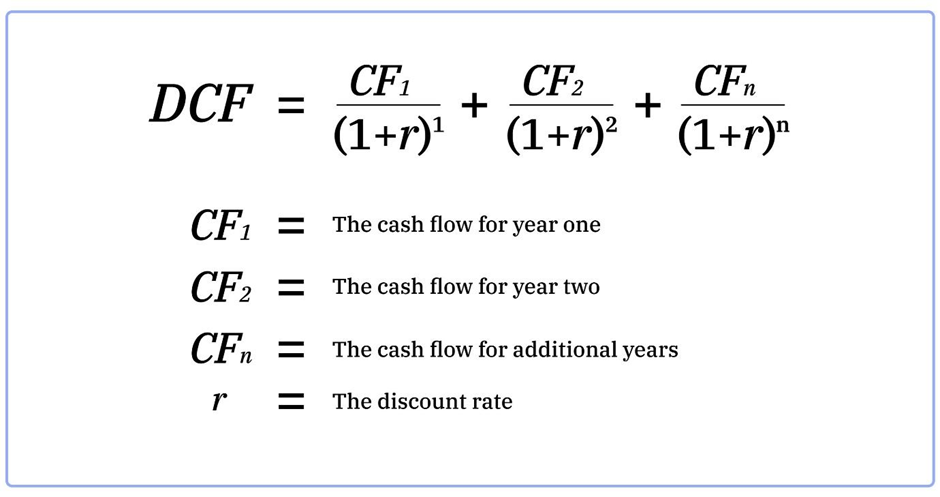

1. Discounted Cash Flow (DCF) Model: This model estimates the present value of future cash flows generated by an asset, such as a business or project. It involves forecasting future cash flows and discounting them back to their present value using a discount rate, typically the cost of capital.

2. Dividend Discount Model (DDM): This model estimates the value of a stock based on the present value of its future dividends. It’s applicable for companies that pay dividends regularly and have stable dividend growth.

3. Residual Income Model (RIM): This model values a company based on the equity investors’ residual claim on the company’s earnings after deducting the cost of equity capital. It accounts for the opportunity cost of equity capital.

Leave a comment